Are weight-management medications covered by insurance?

Agonists. Dual agonists. Triple agonists! We’re living in a golden age of obesity drug innovation. That’s good news for the more than 40% of adults in the U.S. living with obesity. But these advancements won’t do much good if no one can afford them. Here’s what to know about navigating insurance coverage for weight-management medications, including appeals, cost-savings programs, and why cheaper so-called dupes might not be worth it.

How much do prescription weight-loss medications really cost?

Prescription medications of all kinds are generally pricey — it’s just that most of us never see their true cost because they’re typically covered by insurance. Weight-loss medication is no different, and retail prices often exceed $1,000 per month, particularly for the newer GLP-1s. This is due, at least in part, to the fact that many of these drugs don’t have a generic version yet, which tends to bring prices down when it becomes available. The higher price tag also reflects research and development costs that went into getting a patent and FDA approval, according to the American Medical Association.

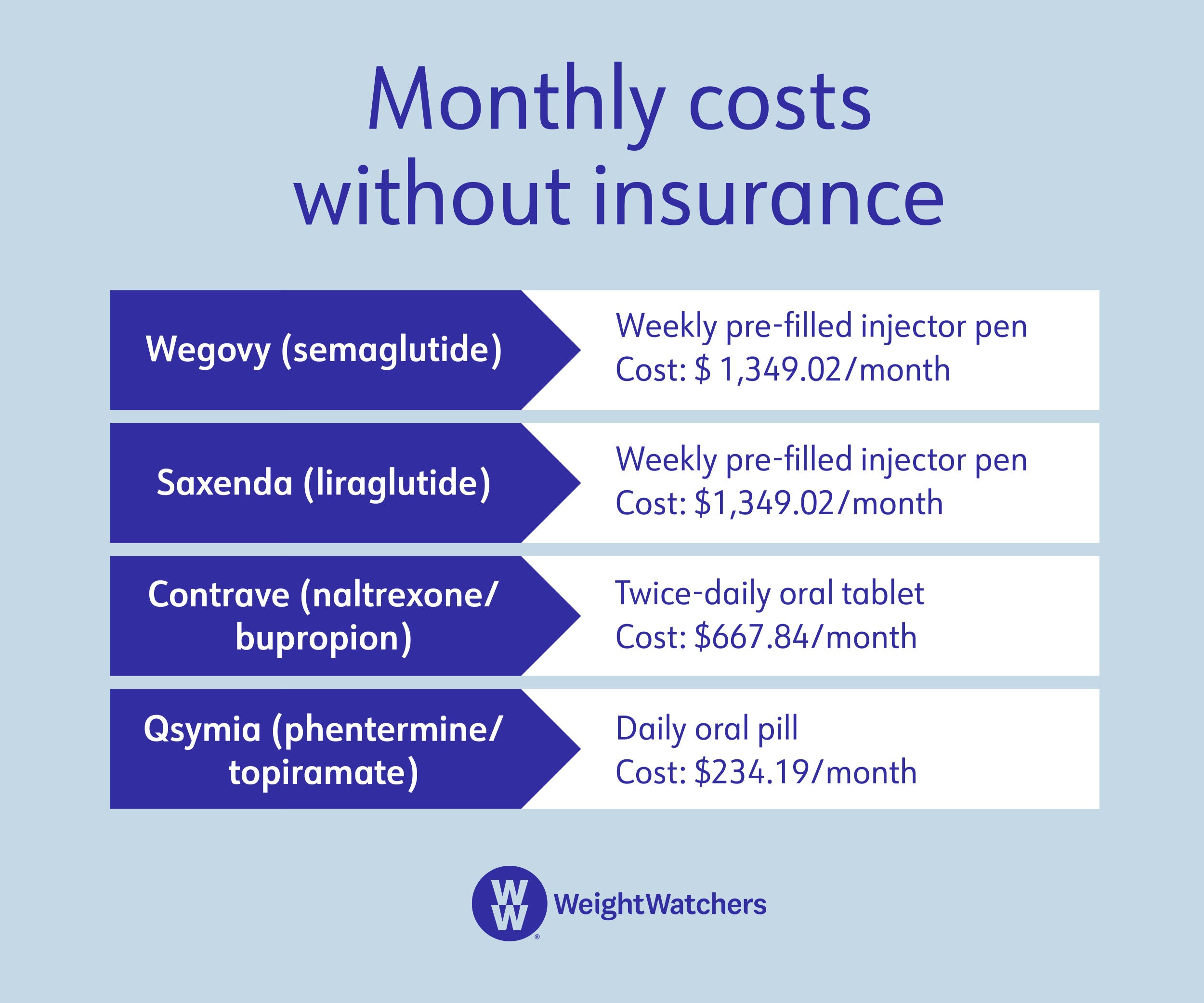

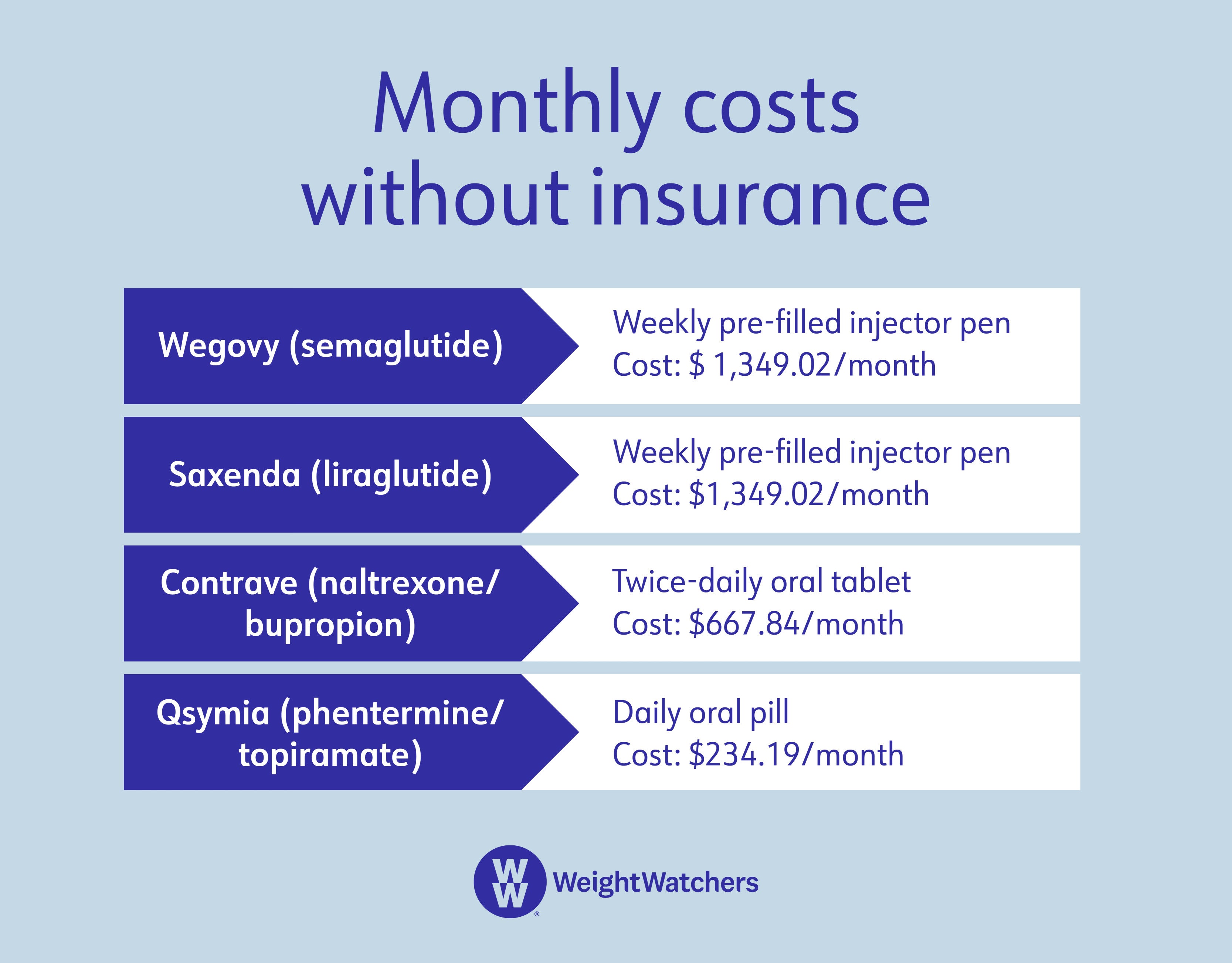

Here’s a rundown of the list prices (a.k.a. what you’d pay without any insurance coverage) for prescription medications that are FDA-approved for chronic weight management:

Which prescription weight-loss medications are covered by insurance?

We wish we didn’t have to say it depends. But…it depends. And that’s because everyone’s insurance carrier and specific plan is different. Unfortunately, “weight-loss medication is often not covered at all,” says Dr. Robert Kushner, M.D., a professor of medicine and medical education at Northwestern University’s Feinberg School of Medicine in Chicago. The only way to truly know what’s covered for you is to look up your insurance plan’s formulary — i.e. its database of covered medications.

It’s also important to note that even if your insurance does cover weight-management medications, that doesn’t mean your insurance covers weight-management medications for you—a patient needs to meet certain criteria in order to be eligible for that coverage. Generally, that means a BMI of 30 and up, or a BMI of at least 27 plus a qualifying condition, such as hypertension or diabetes.

Are off-label medications any cheaper?

Healthcare providers consider various factors, including cost, in determining whether to prescribe an off-label medication, says Dr. Charlie Seltzer, M.D., an obesity specialist based in Philadelphia. That means someone may be prescribed medication that’s FDA-approved for an unrelated condition, but that the healthcare provider believes is also effective at treating obesity.

“This is common, and is likely in up to 20 percent of prescriptions–not just for obesity but for numerous conditions,” Seltzer says. “In some cases, a drug is used off-label for a time and then is approved for that purpose, making it on-label.”

An example is a drug called topiramate, he adds. Initially approved for use in treating migraines and seizure disorders, it was shown to reduce weight in patients with a body mass index over 30, and subsequently became approved for that purpose when combined with another drug (phentermine).

Off-label prescriptions can get tricky with insurance because, just like on-label usage, coverage varies. However, requesting prior authorization from an insurance company can sometimes be helpful, since you’ll know it’s covered before the prescription is written, Seltzer says.

What about compounded weight-loss medications?

These are all over TikTok as cheap alternatives, which should immediately raise skepticism. And the FDA has noted their risks.

“Compounding pharmacies make drugs in formulations that aren’t commercially available,” says Seltzer. “They can also produce medication when there are shortages, which is what’s happening right now with weight-loss medications. However, they’re not supposed to compound drugs that are commercially available.”

That means a pharmacy can provide a semaglutide option, but it won’t be exactly the same as a drug like Wegovy. And while it may still have a therapeutic effect, there is no guarantee how much or how safe it is since that particular formulation hasn’t been studied and approved by the FDA.

Physicians use compounding pharmacies mainly to create formulations or dosages they can’t get through standard pharmacies. For example, compounding pharmacies can make gummies or lollipops of certain drugs for people who have trouble taking pills, or turn some medications into topical creams.

The big takeaway here — take note, TikTokers — is that these medications still have to be prescribed by a physician, says Seltzer. “Anything you can order online for yourself from one of these pharmacies shouldn’t be trusted,” he adds.

Why aren’t more prescription weight-loss medications covered by insurance?

For starters, Medicare currently doesn’t cover most forms of obesity procedures and medications. That means 65 million people in the U.S. who are on Medicare are not covered. There is bipartisan legislation pending called The Treat and Reduce Obesity Act, but it will take time to make its way through Congress, and passage isn’t guaranteed. Although Medicare represents only those over age 65, it sets a tone for insurance companies about what should be covered.

Experts interviewed for this piece also note there’s likely weight bias at play. Despite the fact that obesity was recognized as a disease by the World Health Organization in 1997 and by the American Medical Association in 2013, many people—and insurance companies—may view it as a condition that is fully within people’s control, despite significant research demonstrating the biological drivers of obesity.

For those who don’t have Medicare, approval delays may happen because many weight-loss medications are still relatively new, particularly the GLP-1s. Insurance companies can take some time to fully review them. “Even though [weight-management medications are] less invasive and have fewer potential adverse events [than bariatric surgery], many insurance companies won’t cover them,” says Jodie Pepin, PharmD, the clinical pharmacy program director for Harbor Health. “Most people pay out of pocket, and the price can easily exceed the cost of [weight-loss] surgery.”

So…when might insurance coverage expand for weight-management medications?

If the federal government begins allowing Medicare coverage for weight-loss drugs, odds are that private health insurance companies will follow suit, says Pepin. This has been the case with many novel drugs in the past, such as the rheumatoid arthritis treatment Humira, which was covered by Medicare part D (prescription drug coverage) in 2020, with private insurance companies adding their own coverage as recently as 2023.

What you can do about it

1. Talk to your healthcare provider. Before you venture down the rabbit hole of medications and coverage, you need to chat with your provider about the best weight-loss treatment plan for you, taking things like cost and insurance into consideration. And that plan may or may not include pharmacological interventions for the treatment of obesity.

Even if your insurer doesn’t cover weight-management medications, obesity treatment can still be an option. Insurers may cover other care, including nutritional counseling and weight-loss programs like WeightWatchers®, which are also eligible for HSA or FSA reimbursement. Keep in mind that this doesn’t mean you need an either/or approach of weight-loss medication versus weight-management program—the two can complement each other, and an insurer may cover both options at the same time.

2. Advocate for yourself. If your insurance company has denied coverage, reach out. Kushner suggests asking your provider to write an appeal letter on your behalf. (This coverage request letter template may be a good starting place for your provider.) Once submitted, the process moves pretty quickly. “It’s often 48 to 72 hours for a response to a submitted appeal letter—but sometimes it’s longer,” explains Kushner. This is one of those situations where being a member of WeightWatchers Clinic can help: Your care team includes an insurance coordinator to maximize your coverage.

If you get insurance through your employer, you can also talk to your HR department about the issue. They may be well versed in what’s covered and what’s required to get approval. You can also ask them if there's another plan the company offers (or could offer) that may be a better fit for your needs, and whether you can switch to that during open enrollment.

3. Shop around. Weird, but true — not every pharmacy charges the same price for every drug. Your out-of-pocket cost decreases for coinsurance and uncovered medications when you choose the pharmacy with the lowest price.

4. Check for discounts. Many drug manufacturers have savings programs that might be able to help. But you’ll have to research cost-savings programs for each individual drug your healthcare provider is considering to prescribe for weight management. You can find detailed information about program eligibility, discounts, and applications on the manufacturer’s website.

Applying for these programs can get overwhelming because they are sometimes complicated. Health insurance is part of the eligibility criteria, but many times people who have state or federal health insurance like TRICARE, Medicaid, or Medicare aren’t eligible—and the criteria and savings can change without notice.

If you need help, ask a pharmacist. They’re the healthcare providers who usually have the most experience with these programs, so they should be able to give you a bit of guidance. They can be particularly helpful when savings cards are about to expire or already have, says Seltzer.

The bottom line

Pursuing sustainable weight loss can be tricky, especially if you’re using weight-loss medication to reach your health goals. Since many of these medications are relatively new and obesity wasn’t recognized as a disease until recently, not all health insurance companies cover them. This can make for steep out-of-pocket costs for patients. While coverage will likely expand in the near future, there are steps you can take to minimize your expenses now, including enlisting your provider’s or pharmacist’s help to appeal coverage denials and/or identify the lowest cost medications, and applying for manufacturer cost-savings programs. Just remember that weight-management medication should be one part of a larger medical weight-management treatment plan that's made in collaboration with your healthcare provider.

Anti-obesity medications: International Journal of Obesity (2022). “Effectiveness of anti-obesity medications approved for long-term use in a multidisciplinary weight management program: a multi-center clinical experience.” https://doi.org/10.1038/s41366-021-01019-6

Obesity statistics: Centers for Disease Control and Prevention (2021). “Adult Obesity Facts.” https://www.cdc.gov/obesity/data/adult.html

Health insurance statistics: Centers for Disease Control and Prevention (2019). “Health Insurance Coverage.” https://www.cdc.gov/nchs/fastats/health-insurance.htm

Mounjaro (tirzepatide) efficacy: New England Journal of Medicine (2022). “Tirzepatide Once Weekly for the Treatment of Obesity.” https://doi.org/10.1056/nejmoa2206038

Prescription drug prices: American Medical Association (2019). How are prescription drug prices determined?” https://www.ama-assn.org/delivering-care/public-health/how-are-prescription-drug-prices-determined

Topiramate and weight loss: Journal of Research in Medical Sciences (2013). “The effect of topiramate on weight loss in patients with type 2 diabetes.” https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3793374/

Medicare and obesity coverage: 117th Congress (2021). “Treat and Reduce Obesity Act of 2021.” https://www.congress.gov/bill/117th-congress/senate-bill/596/text

FDA’s views on compounded pharmacies: Food and Drug Association (2022). “Compounding and the FDA: Questions and Answers.” https://www.fda.gov/drugs/human-drug-compounding/compounding-and-fda-questions-and-answers